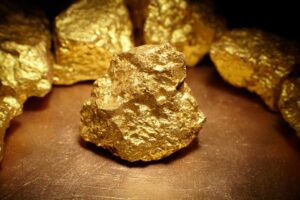

Gold Prices Dip in Asian Trade Amid Expectations of U.S. Rate Cuts

Gold prices weakened during Asian trading on Monday, receiving limited support from rising expectations of U.S. interest rate cuts as traders awaited further cues from the Federal Reserve and U.S. economic data this week.

The yellow metal remained within a trading range established throughout most of June, making little progress even as the dollar declined.

Spot gold edged down to $2,325.74 an ounce, while gold futures expiring in August dropped 0.2% to $2,336.05 an ounce by 00:09 ET (04:09 GMT).

Gold Stagnates Despite Increased September Rate Cut Bets

Sentiment towards the metal markets, particularly gold, remained subdued even as traders heightened their expectations for a rate cut in September, following last week’s PCE price index data.

The dollar index fell by over 0.2% on Monday, continuing its losses from the previous session.

According to the CME Fedwatch tool, traders are now pricing in nearly a 58% chance for a 25 basis point cut in September.

Despite the potential for lower rates being favorable for metal markets, prices saw little movement as traders awaited a series of cues from the Fed and economic data this week. Fed Chair Jerome Powell is set to speak on Tuesday, followed by the release of the minutes from the Fed’s June meeting on Wednesday. Additionally, nonfarm payrolls data for June is due on Friday.

Other Precious Metals Decline

Other precious metals also trended lower on Monday. Platinum futures fell 0.5% to $1,004.60 an ounce, while silver futures dropped 0.5% to $29.405 an ounce.

Copper Prices Retreat on Mixed China PMI Data

Among industrial metals, copper prices retreated on Monday, extending recent losses as sentiment was affected by mixed economic readings from China, the world’s largest importer of copper.

Benchmark copper futures on the London Metal Exchange fell 0.6% to $9,545.50 a tonne, while one-month copper futures dropped 0.5% to $4.3550 a pound.

Sentiment towards China soured further this week after government purchasing managers index data released on Sunday showed the country’s manufacturing sector contracted for a second consecutive month. However, private data released on Monday indicated the sector grew at its fastest pace in three years.

These mixed readings left traders uncertain about the extent of economic recovery in China, leading to significant losses for copper throughout June.

.

#everyday_information #forex #option #Binary_Option #trading #trader #goldstocks #forextrader #fx_trade_time #fxttime #USDollar #euro #JPY #GBP #chfcurrency

#dubai #UAENews #ksasaudiarabia #Syrian #iraq #kuwait #jordan #morocco #Libya #tunisia #algerian #Egypt #qatar #lebanon

#كل_يوم_معلومه #فوركس #خيارات_ثنائيه #تداول_عملات #بورصه #ذهب #فوركس_تريد_تايم #اف_اكس_تريد_تايم #دولار #يورو

#دبي #امارات #السعوديه #سوريا #العراق #الكويت #الاردن #المغرب #ليبيا #تونس #الجزائر #مصر #قطر #لبنان

.

www.fxttime.com/trade